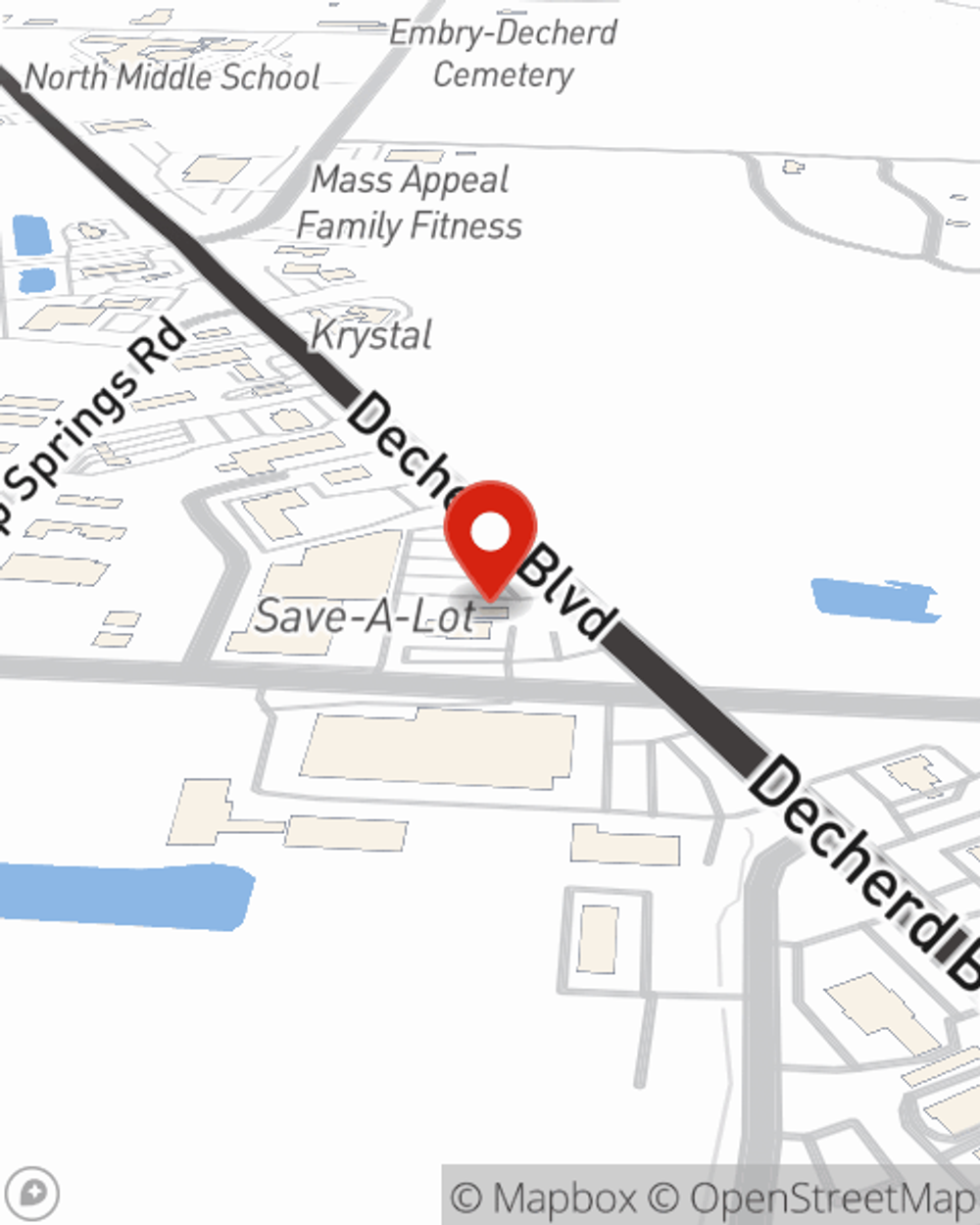

Condo Insurance in and around Decherd

Condo unitowners of Decherd, State Farm has you covered.

Protect your condo the smart way

- Decherd, TN

- Winchester, TN

- Estill Springs, TN

- Cowan, TN

- Huntland, TN

- Belevidere, TN

- Sewanee, TN

- Hillsboro, TN

- Monteagle, TN

- Huntsville, AL

- Montgomery, AL

- Mobile, AL

There’s No Place Like Home

When considering different liability amounts, coverage options, and providers for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condominium but also your personal belongings within, including sports equipment, pictures, furnishings, and more.

Condo unitowners of Decherd, State Farm has you covered.

Protect your condo the smart way

Put Those Worries To Rest

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from water damage, a windstorm or a tornado.

That’s why your friends and neighbors in Decherd turn to State Farm Agent Nick McCormick. Nick McCormick can explain your liabilities and help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call Nick at (931) 392-4009 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Nick McCormick

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.